December 04 , 2024

Deposits: A smarter way to handle pre-payments and patient credits

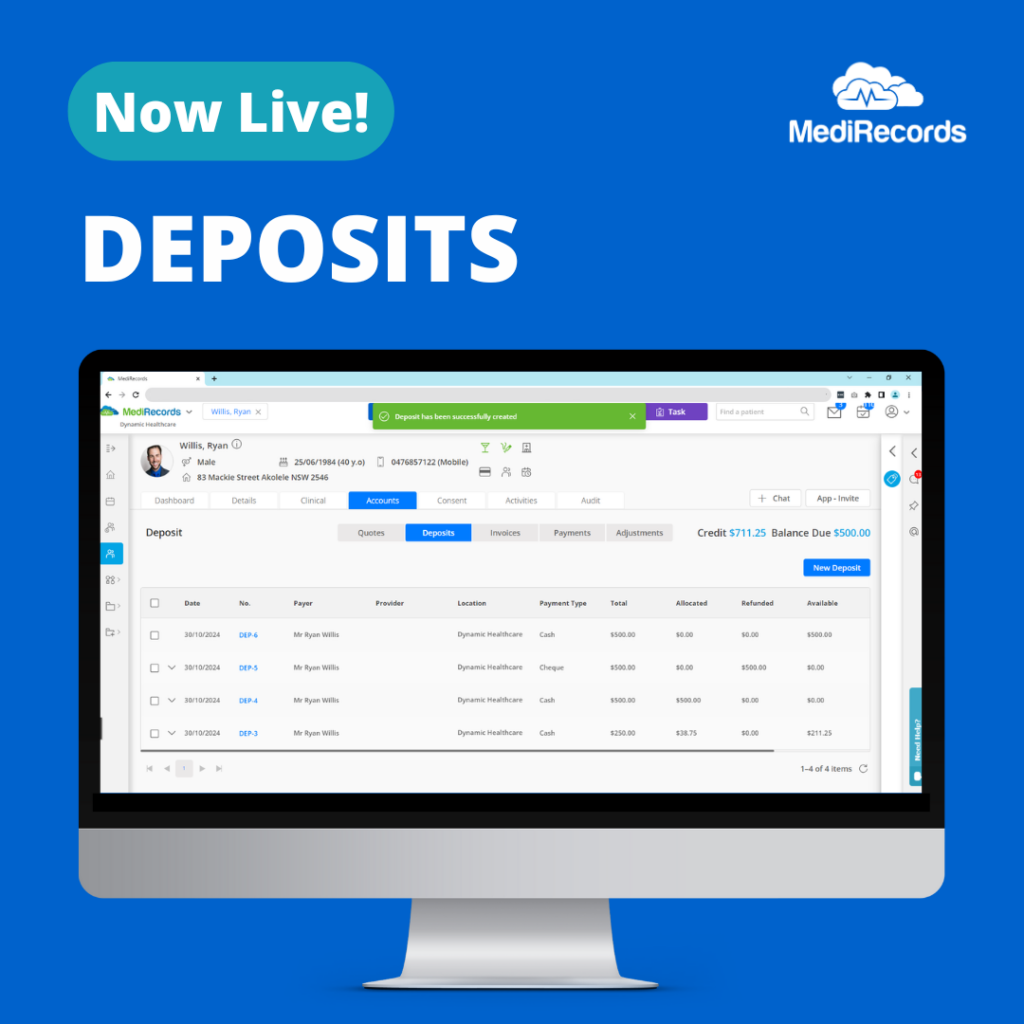

Deposits is now live in MediRecords, providing practices with an easy and organised way to manage pre-payments and payment plans.

Designed for practice managers, billing agents, administrative staff, surgeons, and specialists, Deposits offers an intuitive way to handle funds from the initial quote, right through to the final payment.

With Deposits, users can easily record pre-payments, hold credits in a patient’s account, and apply funds directly to invoices as needed. This dedicated space for deposits in each patient’s account eliminates the need for manual tracking, creating a clear and easy payment process. Deposits provides flexibility to distribute funds across multiple invoices, making it ideal for a range of scenarios—from pre-paid sessions to payments for high-cost surgical procedures.

A new Centralised Billing configuration allows practices with multiple locations to create deposits for different practices within the same MediRecords customer account, without needing to change the viewed practice. This is a game-changer for multi-location practices or practices with central billing teams, providing a more streamlined experience across locations.

MediRecords Product Owner Megan Harker said, “Deposits is designed to be streamlined and flexible. Our goal was to create a feature that could support all service offerings—whether it’s capturing a booking fee when scheduling an appointment or maintaining a record of an incremental payment plan leading up to a procedure. We also prioritised making Deposits information-rich, ensuring that every transaction is recorded in real time, both in the patient record and in reporting.”

Key Benefits of using Deposits

- Easy tracking: Record and track deposits within the patient’s account. A detailed transaction history is available at a glance.

- Flexible application across invoices: Apply funds to one or multiple invoices, or combine deposits into a single payment when covering multiple services.

- Refund and credit options: Refunds can be issued to the patient or held as a credit for future use, providing flexibility for various patient payment preferences.

- Detailed reporting: A dedicated Deposits Report tracks every movement throughout the deposit’s lifecycle, from creation to allocation and refunds. This ensures your practice’s financial incomings perfectly match the bank statement.

- Centralised billing for multi-location practices: Create and manage deposits across multiple practices within the same MediRecords customer account, simplifying payment management for practices with multiple locations.

What makes MediRecords Deposits unique?

MediRecords Deposits goes beyond traditional deposit management by allowing deposits to be shared across multiple providers. This is especially useful for surgical procedures that involve multiple billing parties. A single deposit can be used to pay the primary surgeon, assistant, and anaesthesiologist—all from the same payment.

Our platform also clearly distinguishes between patient credits and outstanding balances, enabling practices to view unpaid invoices alongside available credits in real-time. This structure reduces guesswork in financial reconciliation and promotes more accurate, efficient practice management.

Ready to start using Deposits in MediRecords?

If you would like to read more on how to use Deposits, please visit the following Knowledge Base articles:

Example use case: General practice

Emma books a consultation with her GP and makes a $50 deposit to secure her appointment. After the consultation, the clinic generates an invoice for $120, applies the deposit, and Emma pays the remaining $70 with her credit card, all in one seamless transaction.

Alternatively, if Emma books an appointment and pays a deposit, then needs to cancel, the clinic’s no-show policy allows them to refund $30 while retaining $20 as a cancellation fee, all tracked and processed through MediRecords’ Deposits feature.

Example use case: Surgical procedure

John needs a $10,000 surgical procedure but can’t pay the full amount upfront. The practice uses MediRecords’ Deposits feature to set up a payment plan, allowing John to pay in instalments leading up to the surgery. Once the procedure is completed, the practice consolidates these instalments and allocates the funds across invoices for the primary surgeon, assistant surgeon, and anaesthesiologist. This streamlined process ensures that the practice can easily track payments and maintain accurate financial records while offering flexibility to both the patient and the healthcare team.

Frequently asked questions

Deposits is designed for practice managers, billing agents, administrative staff, surgeons, and specialists who need a reliable method to handle pre-payments, especially for high-cost procedures or multiple-session treatments.

You can record a deposit directly in the patient’s account. Detailed instructions are available in the Knowledge Base under “How to Create a New Deposit?”.

Yes, deposits can be distributed across multiple invoices, making it easy to manage payments for multi-service scenarios or complex billing cases.

Yes, MediRecords offers a dedicated transactional report for deposits, so every deposit’s movement is recorded and can be easily reviewed.

While there is a field available to earmark a deposit for a particular provider, this does not restrict the deposit to only that provider when it is applied to a payment. This flexibility allows a single deposit to be shared among all applicable staff members. For example, a primary surgeon, assistant, and anaesthesiologist can all be invoiced using the same deposit.

Yes, with Centralised Billing configuration, users can create a deposit for a different practice within the same MediRecords customer account, without switching views.

A deposit is a holding of funds, so it will not appear on any financial reports as “income” or “payment” until it is allocated to a payment. Similarly, it will only appear on the Banking Report once (on the day it is received) and not again when it is allocated to a payment.

The deposit portion of the payment will be reallocated to the patient’s credit pool, making it available for allocation to a new payment, if desired. If a full refund is needed (meaning the money is returned to the patient) a refund of the deposit can also be processed.

- Health In Sight: April 2025 - 01/05/2025

- Now Live: New Patient Header enhancements - 09/04/2025

- Health In Sight: March 2025 - 27/03/2025